2025-05-25

免责声明 以下所有内容仅供教育和信息参考,不构成任何投资建议。 算法交易和金融市场投资涉及重大风险,可能导致资金损失。您应自行承担所有投资决策的风险。在进行任何交易前,请务必进行独立研究并咨询专业的财务顾问。

今天,我们来一起实现一个经典的带有价格确认的移动平均线交叉策略 (Moving Average Crossover),并看看它在短线交易中的表现。

该策略旨在捕捉外汇市场在短期内的短期趋势。它使用较短周期的移动平均线来识别入场时机,并结合价格行为确认来提高信号的质量,减少噪音影响。

交易规则 :

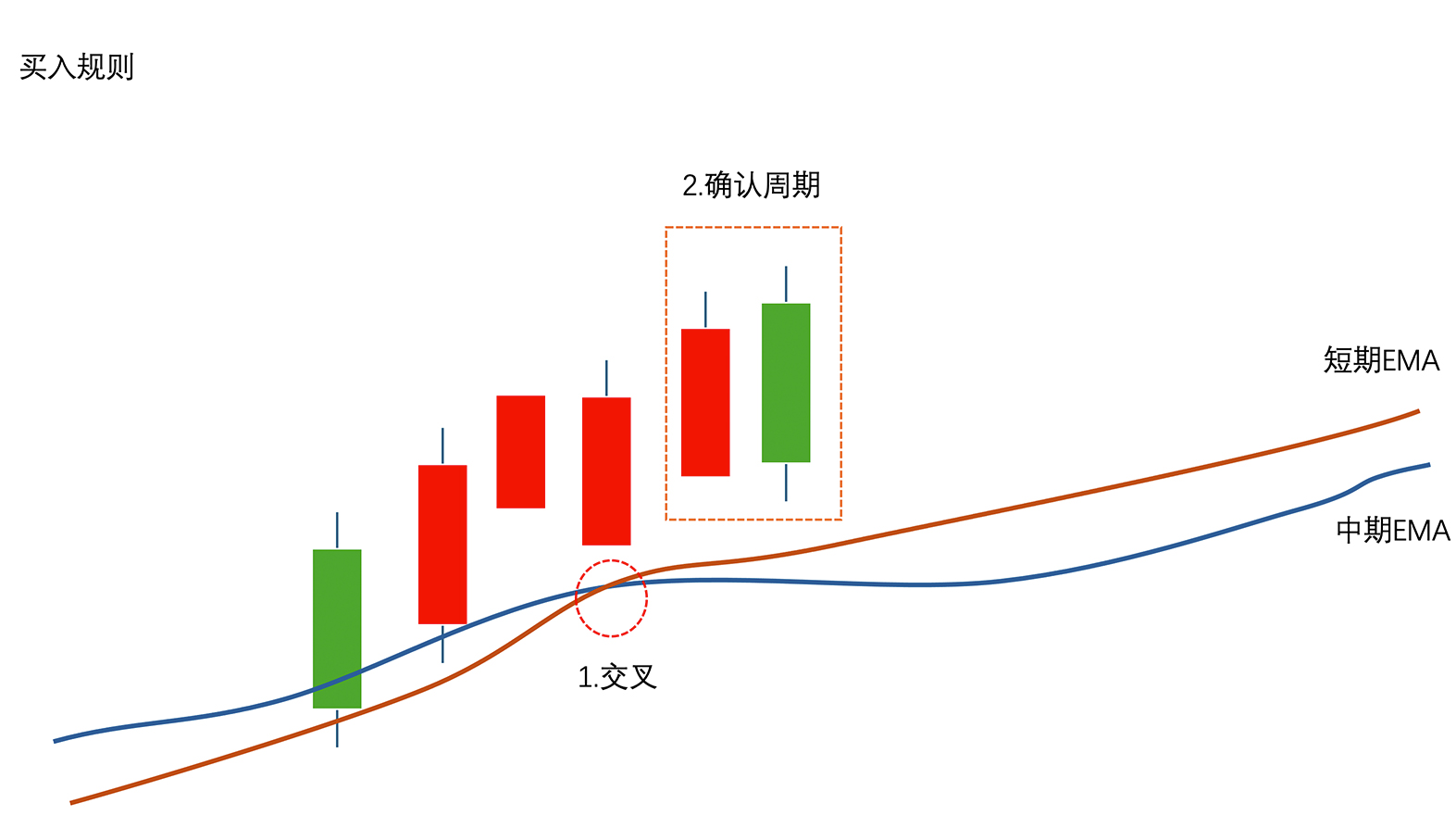

开仓规则:

为了迅速捕捉信号,本示例开仓使用5分钟EMA,短期为6,中期为24,确认为2根K线。(这些参数可以根据自身需要进行调整)

做多:

当短期 EMA 上穿中期 EMA,我们视为潜在做多信号,等待进行价格确认,如果接下来2根K线收盘价均在短期EMA之上则开仓做多。

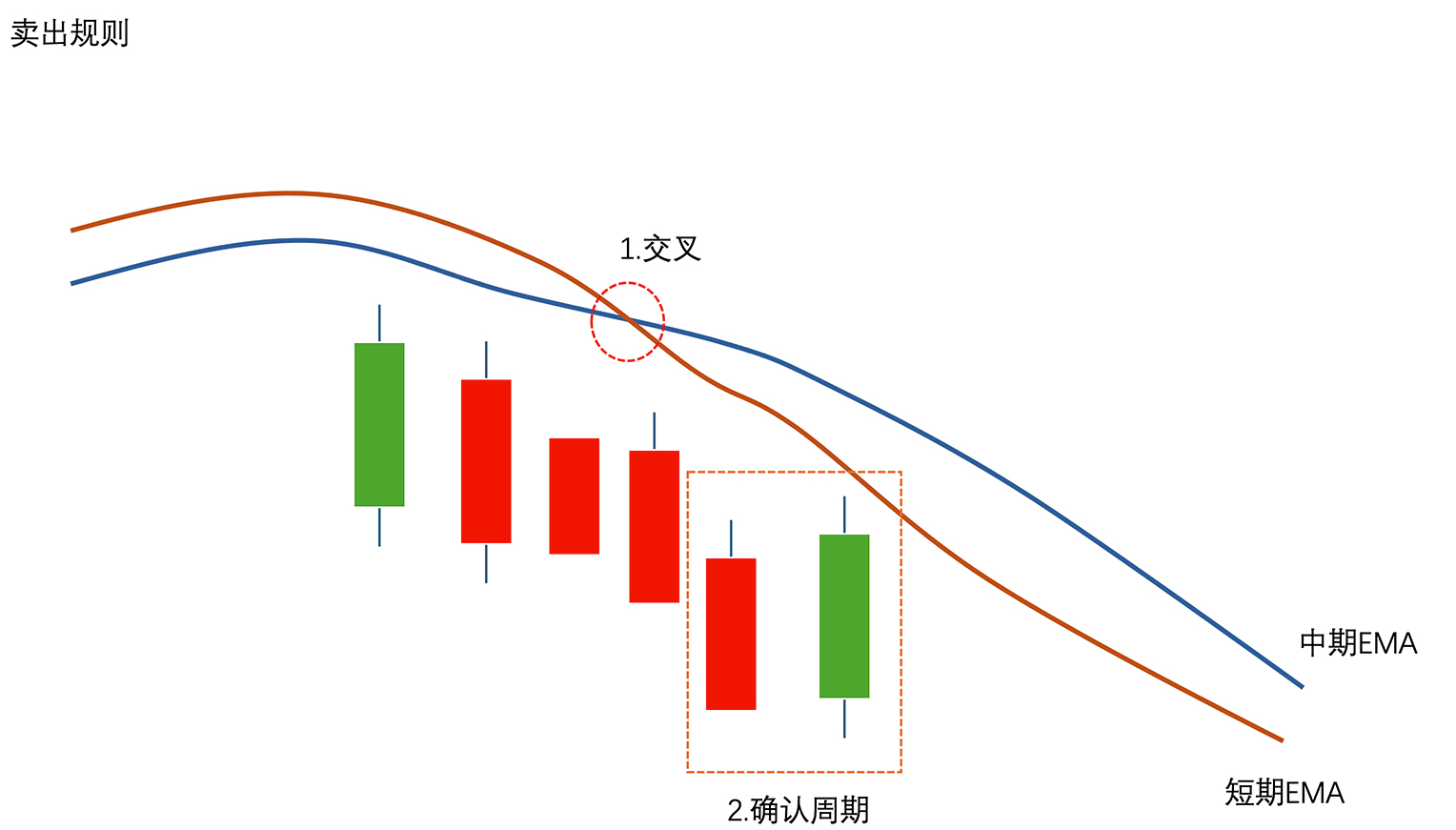

做空:

当短期 EMA 下穿中期 EMA,我们视为潜在做空信号,等待进行价格确认,如果接下来2根K线收盘价均在短期EMA之下则开仓做空。

平仓规则:

留出一定持仓时间,本示例平仓使用1小时EMA,短期为4,中期为24,无确认。(这些参数可以根据自身需要进行调整)

当持有多单时:

- 如果获利超过设定值(600 USD),立即平仓

- 如果短期 EMA 下穿中期 EMA,即出现潜在做空信号时,立即平仓

当持有空单时:

- 如果获利超过设定值(600 USD),立即平仓

- 如果短期 EMA 上穿中期 EMA,即出现潜在做多信号时,立即平仓

主要代码:

识别信号和价格确认

python

def forex_intraday_ma_crossover_with_confirmation(self, timeframe, short_window, medium_window, confirmation_window, op):

"""

适用于外汇周内交易的价格确认的移动平均线交叉策略。

Forex intraday Moving Average crossover strategy with price confirmation.

Args:

timeframe: time frame (时间框架)

short_window (int): 短期 EMA 周期。

Short-term EMA period.

medium_window (int): 中期 EMA 周期。

Medium-term EMA period.

confirmation_window (int): 价格确认周期。

Price confirmation period.

Returns:

signal: 当op=='open'时,返回buy或sell,当op=='close'时,返回close_long或close_short,如果返回空则无信号

When op=='open', returns 'buy' or 'sell'; when op=='close', returns 'close_long' or 'close_short'. Returns empty string if no signal.

"""

max_bars = medium_window + 24 # Maximum bars needed for calculations (计算所需的最大K线数量)

sd_h1 = GetSymbolData(Symbol(), timeframe=timeframe, size=max_bars) # Get symbol data (获取交易品种数据)

signal = '' # Initialize signal (初始化信号)

# Calculate EMAs for crossover detection with shifts (计算用于交叉检测的EMA并考虑偏移量)

short_ema_1 = iMA(sd_h1.close, timeperiod=short_window, matype=EMA, shift=confirmation_window + 1)

medium_ema_1 = iMA(sd_h1.close, timeperiod=medium_window, matype=EMA, shift=confirmation_window + 1)

short_ema_2 = iMA(sd_h1.close, timeperiod=short_window, matype=EMA, shift=confirmation_window + 2)

medium_ema_2 = iMA(sd_h1.close, timeperiod=medium_window, matype=EMA, shift=confirmation_window + 2)

if op == 'close':

# 卖出平多逻辑 (Logic for closing long positions)

if short_ema_1 < medium_ema_1 and short_ema_2 >= medium_ema_2:

signal = 'close_long'

# 买入平空逻辑 (Logic for closing short positions)

elif short_ema_1 > medium_ema_1 and short_ema_2 <= medium_ema_2:

signal = 'close_short'

else:

# 买入逻辑 (Buy logic)

if short_ema_1 > medium_ema_1 and short_ema_2 <= medium_ema_2:

# 检查价格确认 (Check price confirmation)

confirmed = True

for j in range(0, confirmation_window):

short_ema = iMA(sd_h1.close, timeperiod=short_window, matype=EMA, shift=confirmation_window-j)

if sd_h1.close[confirmation_window-j] < short_ema: # If close price is below short EMA, not confirmed (如果收盘价低于短期EMA,则未确认)

confirmed = False

break

if confirmed:

signal = 'buy'

# 卖出逻辑 (Sell logic)

elif short_ema_1 < medium_ema_1 and short_ema_2 >= medium_ema_2:

# 检查价格确认 (Check price confirmation)

confirmed = True

for j in range(0, confirmation_window):

short_ema = iMA(sd_h1.close, timeperiod=short_window, matype=EMA, shift=confirmation_window-j)

if sd_h1.close[confirmation_window-j] > short_ema: # If close price is above short EMA, not confirmed (如果收盘价高于短期EMA,则未确认)

confirmed = False

break

if confirmed:

signal = 'sell'

return signal开仓

python

def open_new_order(self, new_order_list, params):

'''开仓 / Open Position'''

# 最大开仓量为1单 (Maximum open positions is 1)

max_orders = 1

# Get currently opened orders (获取当前已开订单)

opened_order_list = GetOpenedOrderUIDs(scope=DataScope.EA_VERSION)

# 判断是否超过最大开仓量 (Check if the maximum number of open positions has been exceeded)

if len(opened_order_list) >= max_orders:

# Do not open new orders if max limit reached (如果达到最大限制,则不打开新订单)

return False

# 获得开仓信号 (Get the opening signal)

signal = self.forex_intraday_ma_crossover_with_confirmation(timeframe=TimeFrame.M5, short_window=6, medium_window=24,

confirmation_window=2, op='open')

# 如果获得买入或卖出信号,则执行开仓命令 (If a buy or sell signal is received, execute the open order command)

if signal in ('buy', 'sell'):

new_order_dict = {}

new_order_dict['errid'] = 0

new_order_dict['position'] = PositionType.LONG if signal == 'buy' else PositionType.SHORT

new_order_dict['price'] = Ask() if signal == 'buy' else Bid()

new_order_dict['size'] = 1

new_order_dict['tags'] = ''

new_order_list.append(new_order_dict)

return True

return False平仓

python

def close_order(self, order, operation):

'''平仓 / Close Position'''

close = False

# 获利大于 600 直接平仓 (Close position directly if profit is greater than or equal to 600)

if order.profit >= 600:

close = True

else:

# 盈利未达预期,则使用平仓信号判断是否平仓 (If profit is not as expected, use the closing signal to determine whether to close)

signal = self.forex_intraday_ma_crossover_with_confirmation(timeframe=TimeFrame.H1, short_window=4,

medium_window=24, confirmation_window=0,

op='close')

# 平掉多单 (Close long positions)

if order.is_long() and signal == 'close_long':

close = True

# 平掉空单 (Close short positions)

elif order.is_short() and signal == 'close_short':

close = True

#是否执行平仓 (Whether to execute the closing operation)

if close:

CloseOrder(order.uid, volume=order.volume, tags='')

return True # Order was closed (订单已平仓)

return False # Order was not closed (订单未平仓)回测:

使用EURUSD 3个月数据进行回测,3000 USD资金,获利 1475 USD,但最大回撤也高达32%。

| testEURUSD_TP_Demo1_90d | Total/Avg | ||

|---|---|---|---|

| 1 | Start Time | 2025-02-21 00:00:00 | 2025-02-21 00:00:00 |

| 2 | End Time | 2025-05-21 23:59:00 | 2025-05-21 23:59:00 |

| 3 | Init Balance | 3000.0 | 3000.0 / 3000.0 |

| 4 | Symbol | EURUSD | EURUSD |

| 5 | Currency | USD | USD |

| 6 | Leverage | 400 | 400 / 400.0 |

| 7 | Spread Points | 17 | 17 / 17.0 |

| 8 | Margin Call Level | 120.0 % | 120.0 % / 120.0 % |

| 9 | Stop Out Level | 98.0 % | 98.0 % / 98.0 % |

| 10 | Ticks | 91464 | 91464 / 91464.0 |

| 11 | Balance | 4475.0 | 4475.0 / 4475.0 |

| 12 | Total Net Profit | 1475.0 | 1475.0 / 1475.0 |

| 13 | Total Net Profit Rate | 49.17 % | 49.17 % / 49.17 % |

| 14 | Sharpe Ratio | 0.2 | 0.2 / 0.2 |

| 15 | Sortino Ratio | 0.31 | 0.31 / 0.31 |

| 16 | Absolute Drawdown | -615.0 | -615.0 / -615.0 |

| 17 | Max Drawdown | -1131.0 | -1131.0 / -1131.0 |

| 18 | Max Drawdown Rate | -32.21 % | -32.21 % / -32.21 % |

| 19 | Min Volume | 1 | 1 / 1.0 |

| 20 | Max Volume | 1 | 1 / 1.0 |

| 21 | Total Trades | 27 | 27 / 27.0 |

| 22 | Profit Trades | 12 | 12 / 12.0 |

| 23 | Win Rate | 46.15 % | 46.15 % / 46.15 % |

| 24 | Trade Max Profit | 642.0 | 642.0 / 642.0 |

| 25 | Trade Avg Profit | 375.33 | 375.33 / 375.33 |

| 26 | Trade Max Loss | -749.0 | -749.0 / -749.0 |

| 27 | Trade Avg Loss | -216.36 | -216.36 / -216.36 |

| 28 | Loss Trades | 14 | 14 / 14.0 |

| 29 | Gross Profit | 4504.0 | 4504.0 / 4504.0 |

| 30 | Gross Loss | -3029.0 | -3029.0 / -3029.0 |

| 31 | Short Positions | 8 | 8 / 8.0 |

| 32 | Short Positions Win | 5 | 5 / 5.0 |

| 33 | Long Positions | 19 | 19 / 19.0 |

| 34 | Long Positions Win | 7 | 7 / 7.0 |

| 35 | Max Consecutive Wins | 5 | 5 / 5.0 |

| 36 | Max Consecutive Wins Money | 3093.0 | 3093.0 / 3093.0 |

| 37 | Max Consecutive Losses | 6 | 6 / 6.0 |

| 38 | Max Consecutive Losses Money | -1142.0 | -1142.0 / -1142.0 |